This coronavirus pandemic has brought a lot of changes to everyone, and it has come to my attention that a new wave of Robhinhood traders have come in the picture, spiking google searches like “Best Coronavirus stocks” or “How to make money in Robinhood options trading” and anything in between. While I applaud people’s interest in getting into the industry, as it can really open many doors for you, I find they are not taking a reasonable approach to it and actually have better odds going to a casino and counting Blackjack cards!

The reason I say that last part is that most people I’ve seen – and spoken to – have no notion of risk management and most don’t even know how much risk they are actually taking! It is all getting to a point where people are seriously hurting themselves, such as this guy that killed himself over a Robinhood negative balance. So.. Obviously a change has got to come to better prepare people that want to get into the industry *Enter guys like me*

I’m no millionaire

That’s right, I haven’t ever made a million, in fact most of my money is either invested or being reinvested to secure a basic salary and allow for an end-of-year bonus from my account (which is why I don’t get people that “make money” trading and spend it all on an overinflated and fake lifestyle… Traders are not that lavish really).

My financial situation overview being laid, I want to mention now why I am qualified to guide you into a better way of approaching this wild game. I have spent 4 out of my total 6 years of trading swallowing punches and losses, until I had that “aha” moment where things started to click and consistent profits started to come in along with profitable ideas. Yes, IDEAS! Contrary to popular belief, this is an idea business where the more you understand the economy-sector-industry, the more ideas you will have as to what can happen in the future – and how you can benefit from it -.

Where I got/get my education

Like I said, I believe I am more than qualified to guide you into your new venture in trading (not only because of my many mistakes and lessons) because of my previous and continuous education in the financial markets.

I can attribute a lot of my guidance and trading structure to a handful of books, which I will list in later posts for your educational convenience, and an indirect mentor by the name of Anton Kreil and his amazing organization, the Institute of Trading & Portfolio Management.

Along the above-shown, I am expanding my education daily through my CFA Lv I program and various nano-degrees in Computer Science and Quantitative Finance!

What my plan is for my audience

I won’t say that Anton alone got me on the right track, because in fact it did take (and is still taking) a lot of hard work with studying, analyzing, and managing to have income sources outside of my trading account so that I can let it grow as much as I can. However, what Anton did for me, and what I am trying to accomplish for my audience.

The plan is to take you from an unconscious incompetence (where you don’t know what you don’t know) to a conscious competence (where now you know what you don’t know), this will be your “oh…” moment and hopefully lead to your own “aha!” moment like it did for me.

I will document any and all trades with provided comprehensive PDF reports on the research and reasons behind said trades, which you can get either as an attachment on my blog posts or through a request via email in the “Why you’re here” section. Through reading the posts and the PDFs, hopefully you will be exposed to new and exotic concepts and Excel/Python models that will make your head spin; then you will go to a conscious incompetence level and have your “oh…” moment!

A brief overview of the Professional Trading Process

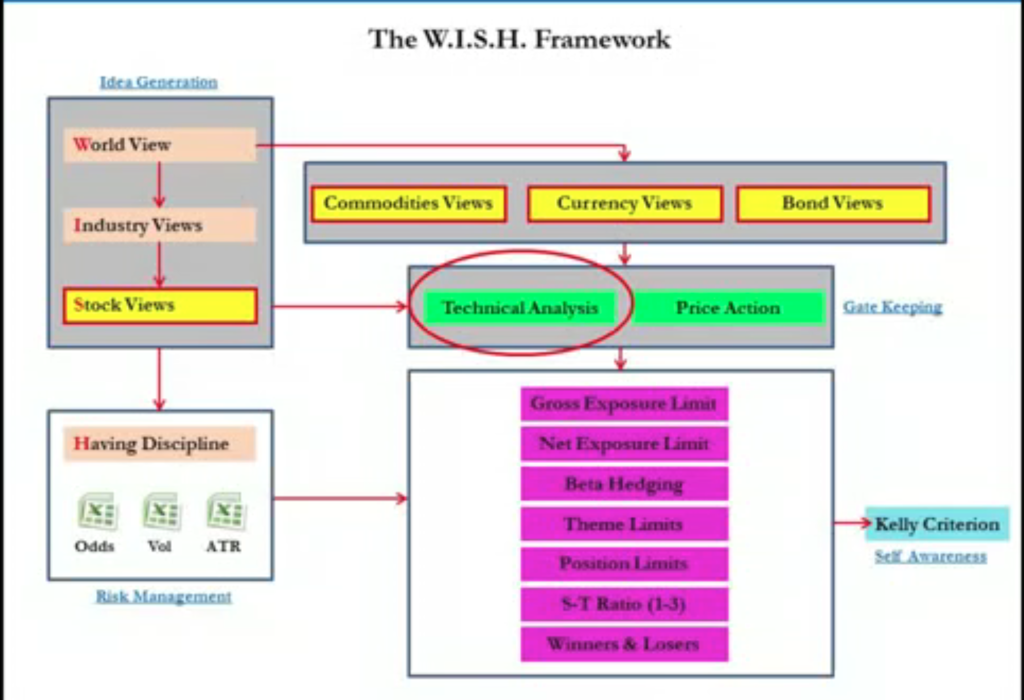

In later posts, I will go over very detailed and comprehensive walk-throughs as to how to generate a profitable trading idea, and furthermore how to execute that idea effectively. However, for the sake of introduction; I want to show you a basic framework that is featured in many Sales & Trading desks around Investment Banks and Hedge Funds. This Framework is very well portrayed under a presentation my Mr. Kreil:

As you can see (and sorry for the low quality), trading Ideas have nothing to do with Technical Analysis and everything to do with understanding Macroeconomic models and how the business cycle works, the only use technical analysis has is that of timing your trades and interpreting whether your thesis is priced in or not!

I find that a good way to look at the approach is to imagine yourself pitching an investment idea to an investor or a big bank. You wouldn’t come to a sophisticated individual and say “You should invest in me because I found a double top/head-and-shoulders/RSI overbought level on a stock!” they will gently hand you their card and never hear from you again! This is all information that EVERYONE has access to and is very easy and quick to interpret, which means there is very little to no margin and a lot of competition in trading this way.

You must understand that short-term trading is a fool’s game unless you have a state-of-the-art Machine learning or Artificial Intelligence model like Renaissance. If you are trading in the short-term on purely technicals, you will have around a 12% probability of making money on longs and about a 3% probability of making money on shorts, this trend is getting worse as the $VIX is on a long-term down-trend.

After you realize this simple fact, you will want to look at the infamous swing trading based on actual facts and reasonable ideas! Which is what non-quants are doing now to make money, FOLLOW THE MONEY. What this entails is taking trades that last anywhere from 1-6 months and have specific catalysts and multiple decision making scenarios. Following the above depicted framework, you would:

- Generate a World View through researching the marco-environment in a specific country and figure out where they are in the economic-cycle and which phase is to follow, then you will know whether to go long / short assets in that economy.

- Hone in on your Industry View after figuring out the future outcome of GDP in that nation, you can generate a view on several indicators like *Inflation, *PMI, *Building Reports, among other key indicators that can guide you into the right sectors to go long / short

- Build your Stock Universe meaning you can pick long / short stocks in the sector/industry you have identified to have value in

- Lastly, apply some Catalysts and Portfolio Management concepts to effectively execute your ideas and profit from them with as little risk as you can.

Examples

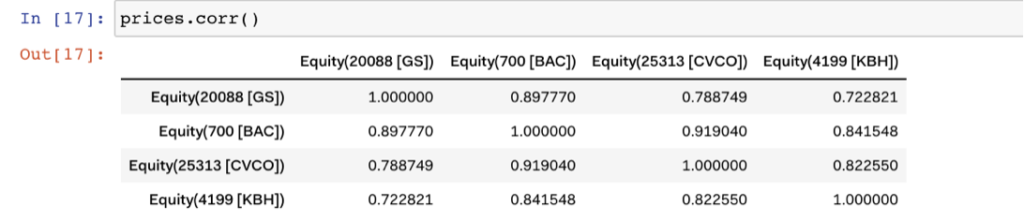

On following posts I will describe the A-Zs of the last trades I’ve taken for a cumulative return-on-account of 5% over the past two weeks (not a superstar, but annualized it looks pretty damn good). Basically took an Equity Spread Trade on $BAC / $GS and $CVCO / $KBH long the first and short the second respectively. These trades have followed the above framework and turned out to have very low volatilities/risks compared to their expected and realized returns thus far, providing a portfolio delta of -1.22 which is amazingly low compared to the exposure I took capital-wise.

Conclusion

Tune in, request your PDFs via email on the mentioned “Why you’re here” section, read up on the concepts you come across, and chat to me in the “Let’s Chat” section.

Don’t fall for these predators saying that trading is easy based on a chart with a bunch of lines that have no value whatsoever, trading is not easy; but it isn’t rocket science either. If done right, there is money and freedom on the other side of the hard work; let’s get there together and spread the word!

Good luck and happy trading,

Gabriel Osorio-Mazzilli